OFX Alternatives in Canada

If you’ve ever sent money overseas, you might have heard about OFX. It’s a popular Australian fintech that offers foreign exchange and international payments services. OFX also allows people track transactions, manage payments and handle finances across borders with ease.

This is quite an important need for immigrants, business owners, and expats in foreign countries as most immigrants have families back home to support and businesses to run. Immigrants are always on the lookout for tools like OFX to send money back to their home country.

But OFX isn’t your only option especially if you live and do business between Canada and Nigeria. This blog introduces you to a range of alternatives that might suit you even better.

Zole: A Fast and Reliable OFX Alternative in Canada

Zole is a great alternative to OFX for Canadians, especially if you’re sending money between Canada and Nigeria. Zole is built for speed, simplicity, and peace of mind. It offers instant transfers and lets you set up recurring payments, so you don’t have to panic when you forget to send money every month; Zole automates your transfers effortlessly. Plus, Zole gives you access to real-time exchange rates for both the Canadian dollar and Nigerian Naira, so you can send money when the rate is in your favor.

But Zole isn’t just a transfer app. It also runs a regularly updated blog focused on financial literacy, offering helpful insights about money management, saving, and smarter transfers and more. In short, Zole is more than just a service—it’s a financial partner.

Button: Send money with Zole today and experience the difference.

Other OFX Alternatives in Canada

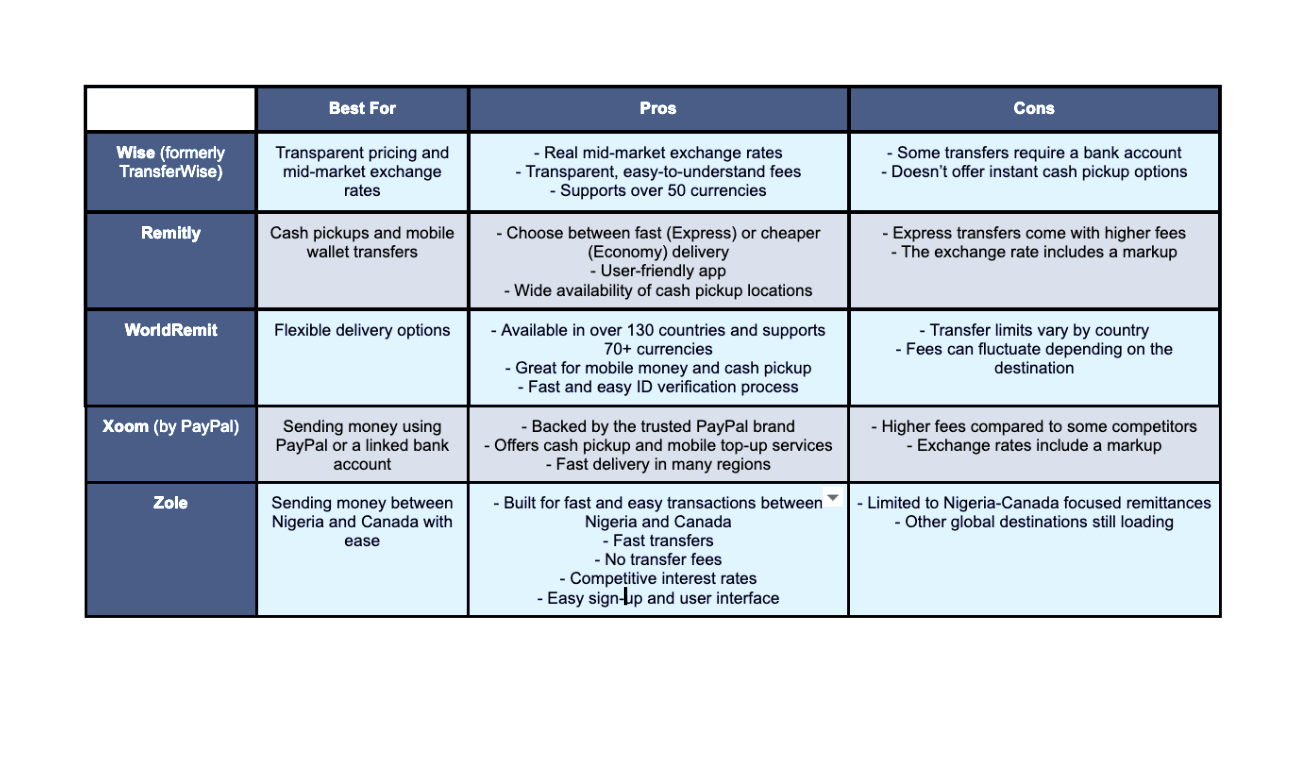

If you’re still exploring your options, here are a few more services to consider:

1. Wise (formerly TransferWise)

Best for: Transparent pricing and mid-market exchange rates

Wise is super popular for a reason—it uses the real exchange rate (just like what you see on Google), and there are no hidden fees.

Pros:

- Real mid-market exchange rates

- Transparent, easy-to-understand fees

- Supports over 50 currencies

Cons:

- Some transfers require a bank account

- Doesn’t offer instant cash pickup options

2. Remitly

Best for: Cash pickups and mobile wallet transfers

Remitly is perfect if your recipient prefers to pick up cash or use mobile money.

Pros:

- Choose between fast (Express) or cheaper (Economy) delivery

- User-friendly app

- Wide availability of cash pickup locations

Cons:

- Express transfers come with higher fees

- The exchange rate includes a markup

3. WorldRemit

Best for: Flexible delivery options

WorldRemit gives you a lot of ways to send money—bank deposits, mobile money, airtime top-ups, and even cash pickups.

Pros:

- Available in over 130 countries and supports 70+ currencies

- Great for mobile money and cash pickup

- Fast and easy ID verification process

Cons:

- Transfer limits vary by country

- Fees can fluctuate depending on the destination

4. Xoom (by PayPal)

Best for: Sending money using PayPal or a linked bank account

If you're already using PayPal, Xoom is a quick way to send money to friends or family abroad.

Pros:

- Backed by the trusted PayPal brand

- Offers cash pickup and mobile top-up services

- Fast delivery in many regions

Cons:

- Higher fees compared to some competitors

- Exchange rates include a markup

Why More People Are Choosing Zole

With OFX alternatives in Canada, there is quite a list to choose from. Platforms like Wise, Remitly, and WorldRemit offer solid options—but Zole goes the extra mile, especially if you’re transferring money between Canada and Nigeria. Zole combines instant transfers, favorable exchange rates, and an easy-to-use, secure app experience. And the best part? No hidden fees and no long delays. Just fast, reliable, and transparent money transfers that work for you.

Comments ()