Money Transfer by Post: How Does It Work?

There was a time when international money transfer meant an envelope, a stamp, and a whole lot of faith. Your uncle in Canada would queue at the post office to send money home, and days (or weeks) later, someone in Lagos would collect a money order from the local post office. Sometimes it arrived. Sometimes… it didn’t.

There is conflicting information online about if mailing cash is still legal today. It would have a lot to do with the laws governing where you live but according to the United States Postal Service, its currency mailing laws have been revised to allow currency be mailed legally however at a peg.

Whether you plan to use it someday or not, it's helpful to know how this method works.

What Is a Money Transfer by Post?

A money transfer by post involves sending funds via a national postal service rather than a bank. It’s a physical transfer of cash, not an electronic one. Check out an overview from Nigeria’s postal system — NIPOST

How It Works (Step-by-Step)

- You go to a Canada Post outlet as if you want to send a letter but you have included cash inside.

- The postal service sends your letter to the destination with the money

- Your recipient picks it up and gets the cash

Why Would Anyone Still Use Money Transfer by Post in 2025?

Despite the rise of Zole and other instant digital options, postal transfers still make sense in specific cases:

- The recipient has no bank account

- The receiving region has limited internet or power

- Just for the thrill and fun of it.

Risks and Drawbacks

Money transfers by post come with several downsides:

- Slow delivery (can take up to 14 days or more)

- Risk of loss is high

- Inconvenience (visits to post offices on both ends)

🔸 Want a safer, faster alternative? Zole lets you send money directly from Canada to Nigeria with no queues or paper forms.

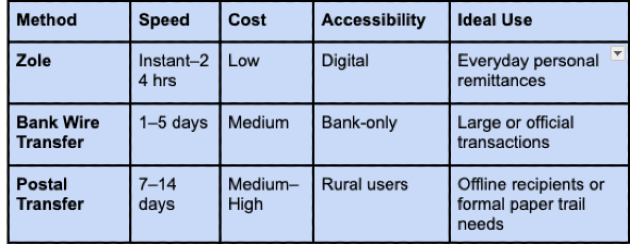

Modern Alternatives vs. Postal Transfers

Zole offers secure transfers to both bank accounts and verified local payout partners. Try it today.

You May Also Want to Read:

Western Union Alternatives for International Money Transfer

How to Send Money from Canada to Nigeria Easily and Securely with Zole

Safety Tips for Sending Money Abroad (Avoiding Scams and Fees)

Conclusion

Just like some people still cherish handwritten letters in a world flooded with emails and instant messages, there are those who enjoy the nostalgia of receiving actual cash by post. There’s something personal about holding the exact note someone sent you, untouched and direct. But let’s be honest—it comes with time delays, risk, and a bit of drama.

If you’d rather skip the uncertainty and keep things fast, safe, and stress-free, Zole is the better choice. It’s instant, secure, and completely free—no envelopes, no waiting, no surprises. Just your money, exactly where it needs to be, right when it matters most.

The Zole Blog is more than just a collection of articles — it’s a vibrant community of Nigerians in Canada and beyond, navigating new beginnings, celebrating milestones, and learning through every step of the journey. We share real-life experiences, practical travel advice, money transfer tips, and so much more to help make your international life simpler, smarter, and more rewarding. Click here to subscribe.

Comments ()