Best Way to Send Money from Canada to Nigeria in 2025

Growing up, many Nigerian families had a Big Daddy London or Big Mummy US; relatives who lived abroad and sent money home to support loved ones. They sent money for school fees, property investment, family upkeep, or major celebrations, remittances were always a way of staying connected and showing care.

Today, that tradition continues. Nigerians in Canada, often children of those same parents are now the ones sending money home. They support parents with medical bills, pay rent for siblings, fund tuition, cover utilities, and even bankroll businesses and building projects.

It’s more than a transaction. It’s life. A way to stay rooted in home especially from across the ocean.

The Real Cost of Sending Money from Canada to Nigeria

Unfortunately, sending money hasn’t always been easy. Traditional banks and remittance services like Western Union or MoneyGram made the process slow, expensive, and complicated. Even some newer platforms come with their own challenges:

Hidden Fees

Unexpected charges show up after you’ve already sent the money. These fees eat into your total and reduce what your recipient receives.

Unfavourable Exchange Rates

You’re already converting CAD to NGN; why should you lose even more to poor rates? Some platforms offer below-market exchange rates, especially for larger transactions.

Long Delays

Waiting days or even weeks for funds to arrive can cause stress, especially in urgent situations like school deadlines or hospital emergencies.

Complicated Processes

Long forms. Multiple steps. In-person verifications. If it takes more than five minutes, it’s already too complicated.

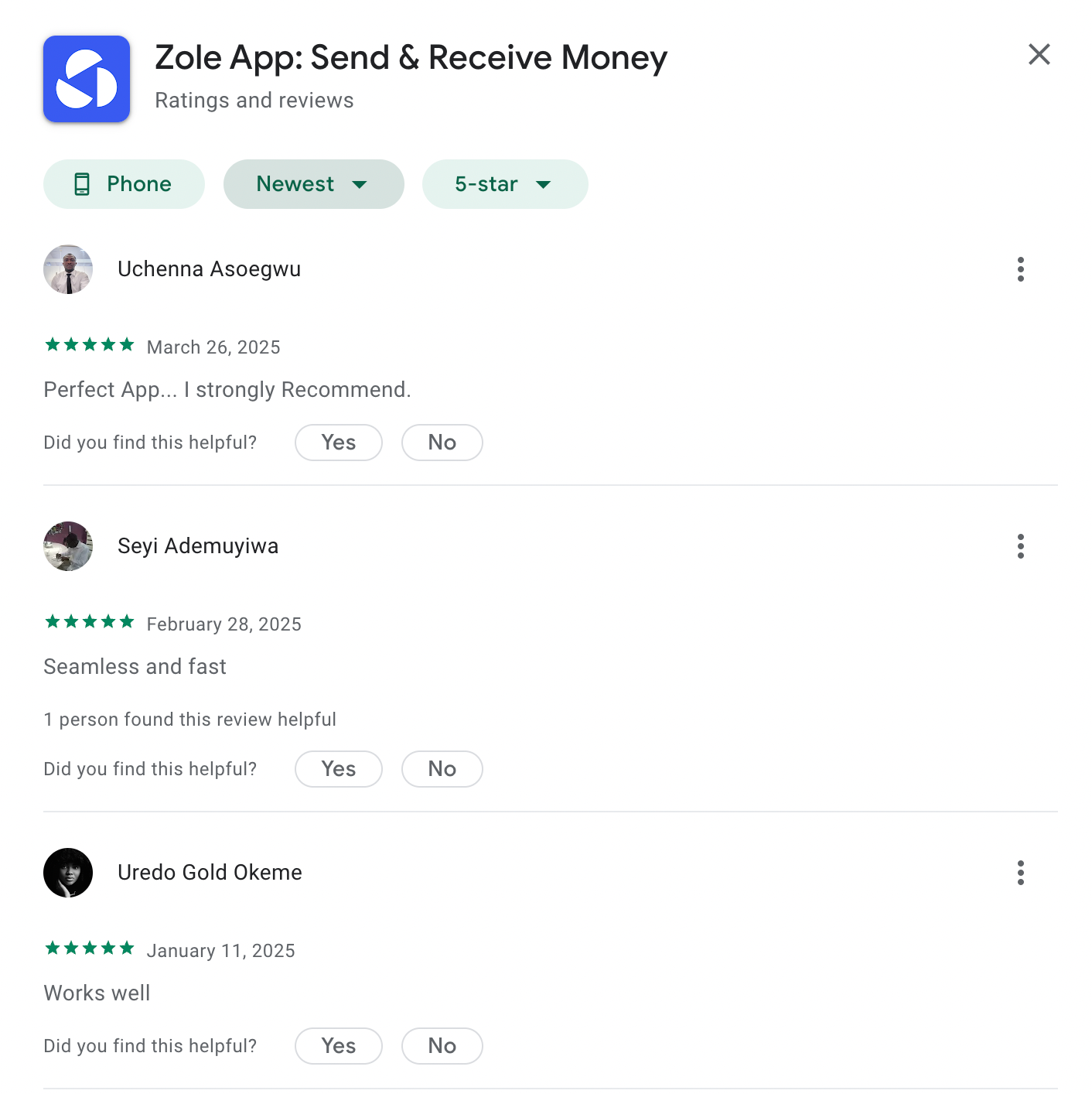

Why Thousands of Nigerians in Canada Use Zole

Zole was created to solve these exact problems. Built for Nigerians living in Canada, Zole makes it fast, free, and seamless to send money home.

✅ Better CAD to NGN Rates

Zole offers competitive exchange rates for all transfers and even better rates for high-value senders. If you send more than $3,000 or ₦3 million, you unlock exclusive rates that beat the average remittance provider.

✅ No Transaction Fees

Send money without worrying about hidden fees or surprise deductions. What you send is what your recipient gets.

✅ Fast Transfers in Under 5 Minutes

Transfers on Zole are completed in minutes, not days. If you're paying tuition or responding to a family emergency, speed matters. With Zole, you’re never left waiting.

✅ Simple App Experience

You don’t need to watch a YouTube tutorial to send money on Zole. The app is clean, intuitive, and built for speed. From sign-up to sending, everything takes just a few taps.

✅ Safe, Secure & Regulated

Zole uses industry-standard encryption and partners with trusted financial networks in both Canada and Nigeria. Your money and your data are always safe.

How to Send Money from Canada to Nigeria in 3 Easy Steps

Getting started with Zole is quick and hassle-free. Here’s how it works:

1. Sign Up and Get Verified

Download the Zole App available on both Google Play Store and Apple Store, and complete onboarding in 5 minutes:

- Verify your phone number

- Verify your email linked to your Interac

- Upload a valid ID. You can either upload your Canadian Passport, Driver’s License, Provincial ID, or your international passport

2. Fund Your Wallet

Use Interac or a debit card to load funds into your Zole wallet.

3. Send to Nigeria

Choose a recipient from your contact list, enter the amount, and hit send. The money arrives in under 5 minutes.

Zole vs. Traditional Remittance Apps

Why Exchange Rates Matter and How Zole Helps You Win

When you’re sending large amounts of money, even a small difference in exchange rate makes a big impact. Zole not only updates rates daily, but also alerts you when rates are in your favor. Plus, senders moving $3,000 or more get special rates, so your recipient gets more Naira for every Canadian dollar.

It’s More Than Money. It’s Staying Connected.

Sending money from Canada to Nigeria isn’t just about bills or transfers. It’s about love. Connection. Showing up for family even when you're thousands of miles away.

At Zole, we get it because we’re part of that story too. We’re here to make it easier for you to send support, build legacies, and stay connected to home.

Ready to Try Zole?

Start sending money the simple way:

✅ Fast transfers ✅ No fees ✅ Better exchange rates ✅ Simple app experience

Get and Use Zole Today

Frequently Asked Questions (FAQs)

How long does it take to send money with Zole?

Less than 5 minutes. Seriously.

Are there any hidden fees?

Nope. What you send is what your recipient gets.

What is Zole’s exchange rate from CAD to NGN?

Our rates are updated daily. You also get better rates when you send more than $3,000 or ₦3 million.

Can I use Zole without a Canadian ID?

You need to verify your identity with a valid Canadian ID or passport. It helps keep everyone safe and secure.

Is Zole safe?

Yes. Zole is fully regulated, encrypted, and trusted by thousands of Nigerians in Canada and at home.

Comments ()