7 Venmo Alternatives In Canada

Have you ever tried using Venmo in Canada and discovered that it doesn't work? Well, that’s because Venmo is strictly for U.S. users, leaving many Canadians searching for alternatives. To use Venmo, you must be in the U.S. and have a U.S.-based phone number.

In this article, we will explore the best Venmo alternatives like Zole which is one of the fastest ways to send and receive international transfers for sending money within Canada and beyond.

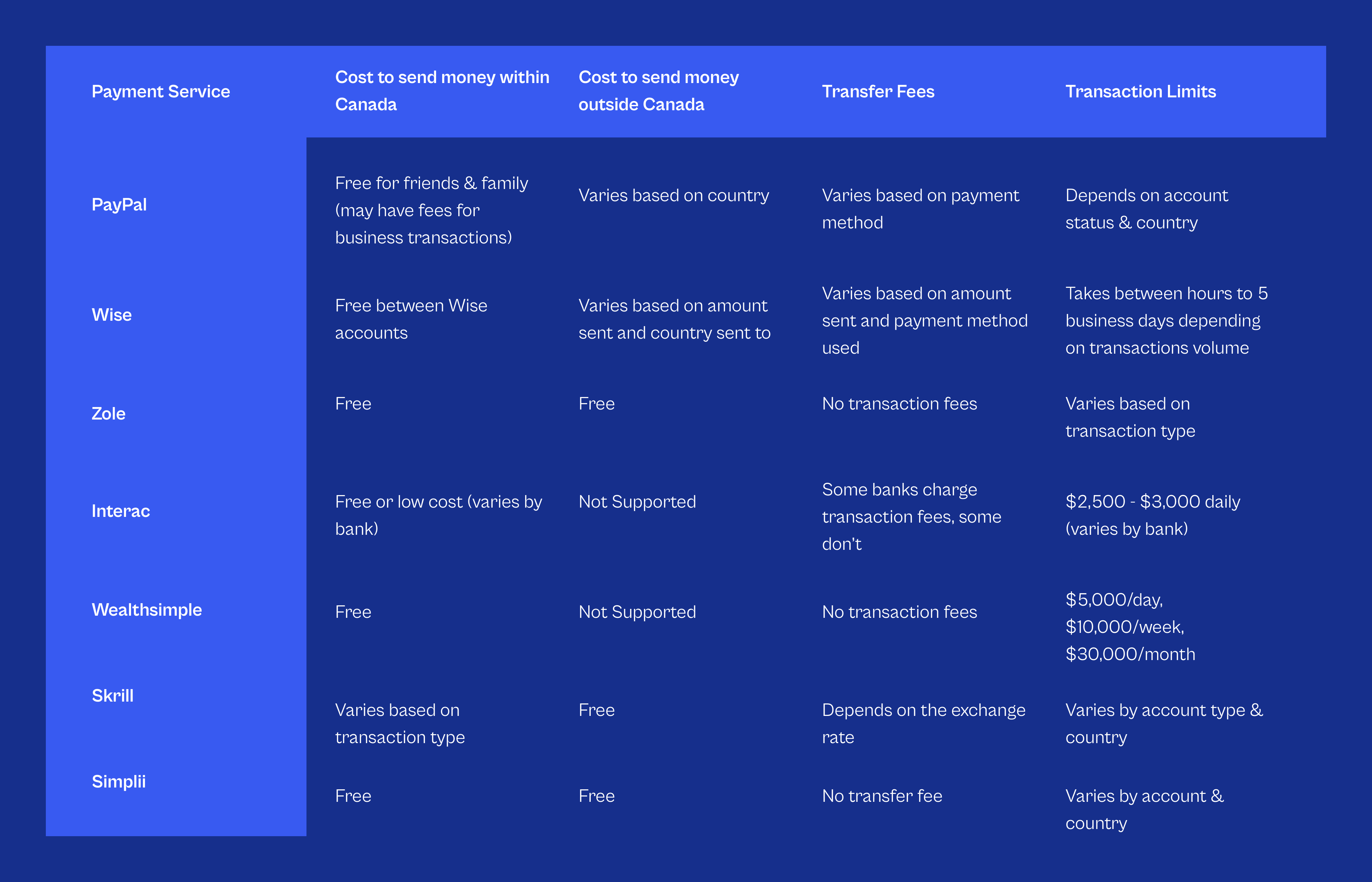

1. PayPal

PayPal, the parent company of Venmo, has a strong presence in Canada and operates in over 200 countries, supporting 25 currencies for seamless international transactions.

However, its exchange rates tend to be higher, and fees can vary based on the country and currency involved. On the plus side, users can earn cashback rewards when using PayPal for certain transactions. It can be used for a couple of things like making online shopping, sending money to friends and family, freelance payments, etc.

Pros

- Widely accepted for online shopping

- Free and easy to open an account

Cons

- Transfers can take 1-3 business days

- High exchange rate markups

2. Wise

Wise is praised for its transparent exchange rates and lower international transfer fees compared to traditional banks. It's an excellent choice for those who frequently send money across different currencies, as its rates are generally more competitive than PayPal’s, helping customers save significantly.

However, Wise does charge both transfer and conversion fees, which vary depending on the amount and currency.

Additionally, the time it takes for money to reach its destination can range from within an hour to 1 to 5 business days, depending on the transaction volume.

Pros

- Low fees

- Transparent exchange rates

- Supports transfers in multiple currencies.

Cons

- Charges both transfer and conversion fees.

- Delayed transfers with certain payment methods

3. Zole

If you are in Canada, Zole is hands down the best option for sending money within Canada and outside Canada. “Your money can reach anyone anywhere” is Zole’s promise which they’re fulfilling with their fast, safe and cost-effective transfers. You can send money to anyone in Canada or send it internationally, with no hidden fees.

Unlike other financial services that often charge high transfer fees and take days to process payments, Zole ensures your money arrives quickly at the best exchange rates, whether you are transferring locally or internationally. Plus, you get better rates when you send high volumes of money.

Pros

- Competitive exchange rates.

- No hidden fees

- Fast, secure, and cost-effective

Cons

- Limited global coverage

4. Interac e-Transfer

Interac e-Transfer is one of the most popular and convenient ways to send and receive money within Canada. With just the recipient’s email or phone number, you can transfer funds instantly, making it a widely used option for personal and business transactions.

It’s supported by most banks and credit unions in Canada, allowing users to send money, pay bills, and even transfer funds between their own accounts.

However, while some banks offer free e-Transfers, others charge a transaction fee. Additionally, the amount you can send depends on your bank, with daily limits typically ranging between $2,500 and $3,000.

Pros

- Easy, fast and secure

- Instant transfers between Canadian banks

Cons

- Transaction limits

- Not available for international transfers

5. WealthSimple

WealthSimple offers a free and convenient way to send and receive money within Canada. With just a recipient’s WealthSimple handle, you can easily transfer funds to family and friends or request payments with no transaction fees.

However, there are transfer limits in place, restricting the amount you can send daily, weekly, and monthly. These limits may vary based on account activity and verification status. Despite this, WealthSimple remains a great option for seamless peer-to-peer transfers, making it easy to split expenses, pay back friends, or move money between accounts effortlessly.

Pros

- Free transfers within Canada

- Simple and easy to use

Cons

- Transaction limits

- Not available for international transfers

6. Skrill

Skrill is an online payment service that offers fee-free international bank transfers while supporting local payments and up to 40 currencies. When sending money, a currency conversion fee may apply.

Transfers to another Skrill user typically include a small markup with a minimum charge, while international bank transfers are free, aside from any conversion fees. Additionally, Skrill features a loyalty program where users can earn points with every purchase.

Pros

- Free international bank transfers

- Loyalty program lets users earn points

Cons

- Exchange rate markup can be high

- Features limited to frequent users

7. Simplii Financial

Simplii Financial is a digital banking division of CIBC, and is a key player in Canada's international transfer market. It enables users to send money to 130+ countries in their preferred currency, offering a fast, secure, and fee-free transfer experience.

However, transfer times typically range between 1-3 business days, depending on factors such as the currency, amount sent, and recipient’s country.

Pros

- Safe and secure

- No transfer fees

- Free international transfers to 130+ countries

Cons

- Delayed transfers

Conclusion

Since Venmo isn’t available in Canada, choosing the right money transfer service depends on your needs. If you need fast transfers, low fees, or international payment options, there’s a great alternative available.

For Nigerians in Canada, Zole stands out as the best choice for fast, affordable, and reliable transfers both within Canada and internationally. If you are looking for an easy way to send money seamlessly, sign up for Zole today!

Comments ()